Reining in the 'chaebol'

South Korea’s mighty conglomerates dominate research and development. But at what cost to innovation? By Mark Zastrow

(From "Horizons" no. 108 March 2016)

When South Korea's President Park Geun-hye swept into office in 2012, she promised to reform the economy. The enormous conglomerates that had long driven the nation's development were struggling to innovate and were stifling entrepreneurship. In response, Park pledged to boost startups by building a ‘creative economy'.

The policy centrepiece is the regional centres where the conglomerates join and work together with local industry and research institutions with a view to nurturing start-ups and investing in them. Since 2014, the government has established 17 such centres, which it hopes will spur growth in sectors ranging from smartphones to smart farms and from shipbuilding to fashion.

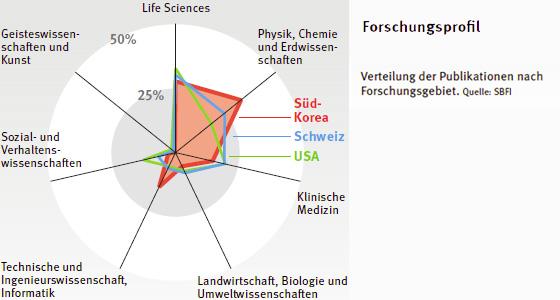

South Korea's commitment to the technocratic path has made it the world's number one spender in terms of research and development as a proportion of GDP. "The investment is pretty unparalleled", says Christian Schneider, head of the Swiss Science and Technology Office in Seoul.

But what really sets South Korea apart is how it spends it: the bulk goes through the conglomerates, or ‘chaebol'. Park is bidding to reposition and leverage these pillars of the South Korean economy, but the enormous influence they wield on research will not disappear anytime soon.

The rise of the chaebol

The chaebol have formed the backbone of Korea's economy since the days of Park Chung-hee, the military dictator who rose to power in the coup of 1963 – and father of the current President Park. He built an economy around the family businesses that he favoured, many of them now global brands like Samsung, LG and Hyundai.

But it was not until the late 1980s that the chaebol began to play an out-sized role in research and development. Often, it took the form of creating universities and in-house laboratories from scratch. For example, it was a steel company that founded what would become the nation's top engineering university, Pohang University of Science and Technology. Samsung followed suit by establishing the Samsung Advanced Institute of Technology (SAIT), an internal lab reminiscent of Bell Labs.

"It was very visionary to build a central corporate research lab in the classical sense", says Ogan Gurel, the chief innovation officer at the Seoul-based start-up incubator Campus D.

Today, the conglomerates are shifting funds to support basic research in universities, says Gurel, who steered SAIT's efforts in this direction as a division leader until 2015. "The scientists apply to Samsung for funding as if it were the government", says Schneider. "It's really a lot of money, and they use it for basic science".

This approach creates unique opportunities for academics to conduct research that has a direct link to the market, says Bernhard Egger, a computer scientist at Seoul National University (SNU). Egger knows both sides of this industrial-academic nexus: he earned his PhD at SNU, the nation's top research university, and then joined SAIT in 2008. There, he helped write the compiler for the company's reconfigurable processor – a low-power chip that decodes video and music in its smartphones. Later, he returned to academia as a professor at SNU, where he still collaborates with Samsung researchers and currently leads one of five research groups funded by Samsung.

What will become of this project is still unknown to Egger. "I think Samsung doesn't know yet either", he says. "So this really is research". But he notes one possibility: last December, Samsung announced it was jumping into the race to develop self-driving cars. "I get the chance to join projects that actually have an impact on the industry, that have some real product behind them", he says.

A remixed economy

Instead of dismantling the chaebol, President Park is trying to convince them to help start-ups by providing facilities, training and capital. For example, in Daejeon, the region's Creative Economy and Innovation Centre is located on the campus of the nation's top technical university. The resident conglomerate is SK Telecom, the nation's largest wireless carrier, and it shepherds projects started by students, to cite just one of many examples.

Critics say these creative-economy centres have yet to bear fruit and note they have failed to yield the desired amount of investment. Many economists argue it will take much more drastic measures to eliminate the chaebol's asphyxiating dominance.

But that has not stopped South Korea from exporting the model to other developing nations eager to copy it. They are willing to pay, too: Saudi Arabia and Brazil have already penned agreements with Seoul to emulate its creative economy.

Based in Seoul, Mark Zastrow is a freelance science journalist and has written for Nature, New Scientist, Nova and Retraction Watch.